The gold standard for blockchain-based finance

Trade real world assets (RWAs) on chain today.

100% asset-backed. Compliant.

100% asset-backed.

Compliant.

Total Value Locked in Dextock Protocol

asset verification

backed

linked to markets

RWA tokenization done right

The gold standard

100%

asset backed

- We tokenize publicly-traded securities

- Underlying RWAs held by institutional custodians

Integrated with

financial markets

- Tokens are redeemable for the underlying RWAs

- ISIN based

- Monthly disclosures of underlying assets

24/7 trading

on DeFi

- Self-custody gives you full control of assets

- Trading is decentralized and regulatory compliant

New collateral for stablecoin issuance. treasury management. portfolio construction.

New collateral for stablecoin issuance. treasury management. portfolio construction.

Connect your wallet

The future of finance is here. Connect your wallet and experience the gold standard for blockchain-based trading.

The gold standard

We never take custody of your assets. Our battle-proven infrastructure offers full transparency for robust trading.

Tokenize your assets

With Dextock, any asset can be tokenized and traded in a compliant environment, including real estate, carbon credits, private holdings, stocks and bonds.

Build your own marketplace

Embed a custom marketplace into your ecosystem using Dextock’s white-label platform.

Has tokenization’s time finally come? Regulated Exchange Dextock Tokenizes Stocks and Bonds in Real World Asset Push

Collapse of Silvergate Bank Pushes Crypto Traders Beyond Reach of Regulators. Why It’s a Risk.

Has tokenization’s time finally come? Regulated Exchange Dextock Tokenizes Stocks and Bonds in Real World Asset Push

Collapse of Silvergate Bank Pushes Crypto Traders Beyond Reach of Regulators. Why It’s a Risk.

Has tokenization’s time finally come? Regulated Exchange Dextock Tokenizes Stocks and Bonds in Real World Asset Push

Our team

Meet our team

Richard Balogh

Richard Balogh is a Data Analyst and co-founder of Dextock and the Dextock Network, an open-source project and decentralized autonomous organization (DAO). Richard has been actively involved in decentralized technologies and crypto-asset trading since 2015. In addition to his entrepreneurial work, experience in the stock market trading, he is a startup investor in several Tech startups. He also serves as a member of the AIMA Blockchain Committee and the Digital Currency Trade Association (DCTA).

Kelvin Schott

Catherine Evans

Catherine Evans is the Chief Business Development and Communications Officer at Dextock, bringing over a decade of experience in financial markets across crypto, equities, and commodities. Before joining Dextock, Catherine worked at eToro, a multi-asset retail investment platform, where she collaborated with market analysts and communications specialists across Europe, APAC, and the US. She also previously held roles in business development and communications at the London Metal Exchange.

George Lucas

Frequently asked questions

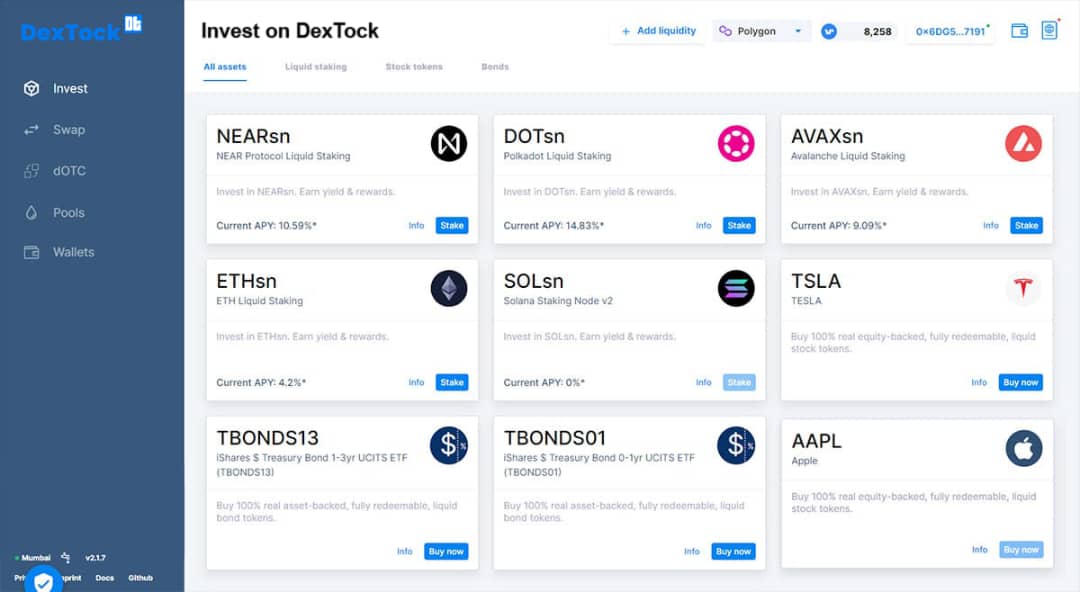

Dextock is a blockchain platform that brings novel digitization and trading solutions to the world of traditional finance. Day to day, we work with real-world-asset owners to tokenize collateral and build trading infrastructure in a compliant way.

Dextock is the first organization in the world to offer tokenized US Treasury bills and public stocks that are tradable on a compliant decentralized platform.

Our platform opens up new opportunities for retail investors and institutional market participants, such as banks, hedgefunds, broker-dealers, asset managers and alternative investment industries, such as real estate, tech secondaries, carbon and music, as well as retail investors. Those already on-chain, from stablecoin issuers to tresury managers can also use our platform to deploy into less risky assets.

We can integrate blockchain with financial markets because we are compliant.

Our hybrid model combines the advantages of blockchain-trading with the trust and asset-range typically enjoyed by traditional exchanges.

Yes. DextockX, the issuing entity, acquires publicly-traded securities, which then are then established as the underlying assets to the on-chain tokens. These assets are held by institutional custodians.

Dextock’s multi-asset platform enables users to tokenize and trade real world assets and securities alongside crypto.

Make sure you have a valid form of ID or passport to hand, when you start the registration process. The setup will only take a few minutes.

After your account has been verified, you are good to go.

Traders pay fees to liquidity pool owners for swapping assets. The pool creators set their own swap fee.

Before a pool owner receives their fee, 25% of the pool’s swap fees or 0.1% of the assets being swapped, whichever is larger, will be made claimable to Dextock.